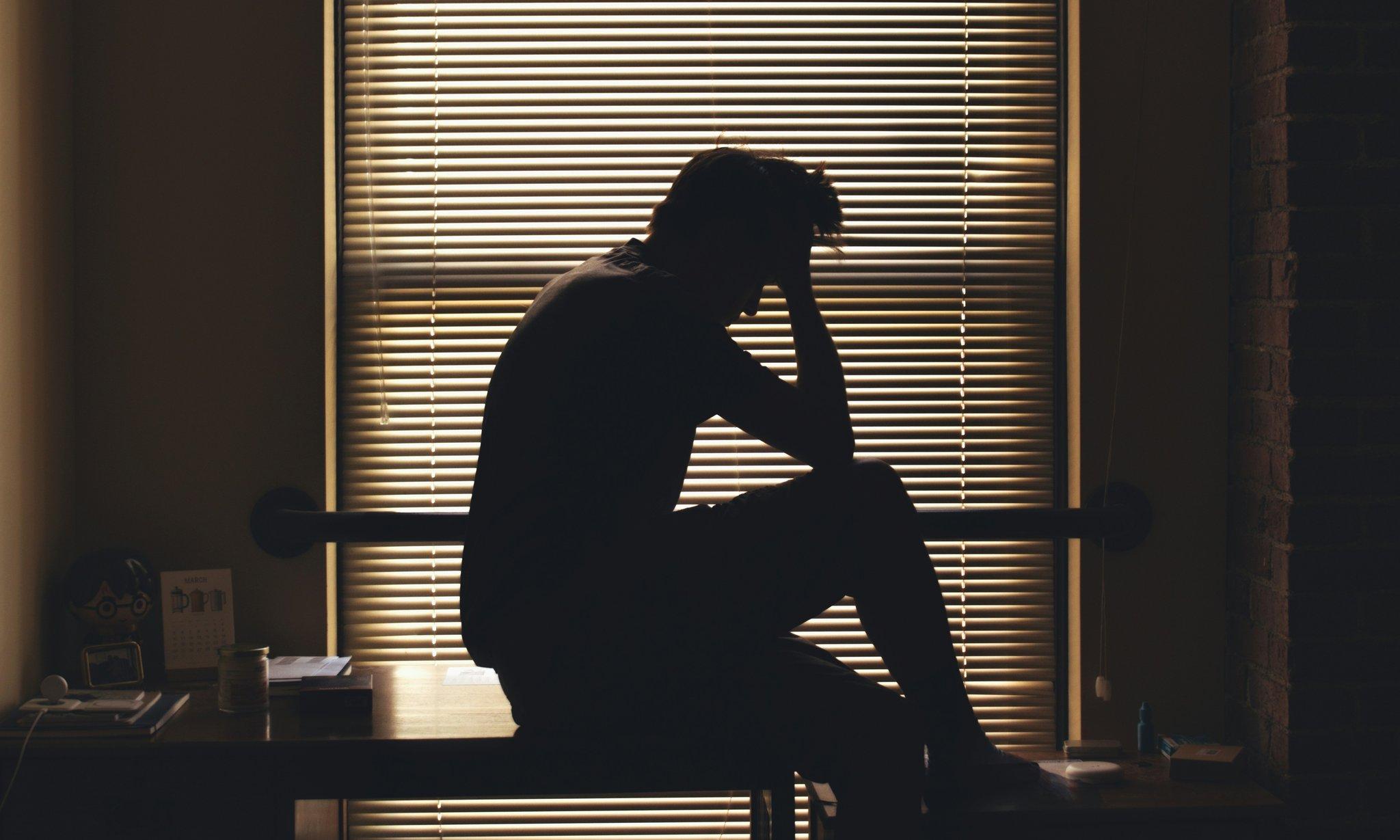

Ever stared at your loan statement, sweating bullets, because you couldn’t make the payment? We’ve all been there—staring into the abyss of numbers while coffee grows cold. But here’s the good news: deferment eligibility can save your financial sanity. It’s like hitting the pause button on life’s chaos.

In this guide, we’re diving deep into everything you need to know about deferment eligibility for loans tied to credit cards and insurance. By the end, you’ll understand who qualifies, how to apply, and what NOT to do (spoiler alert: trust me, it involves email mistakes).

Table of Contents

- What Is Loan Deferment?

- Cracking the Code: Who Qualifies?

- How to Apply Like a Pro

- Top Tips + Terrible Advice To Avoid

- Success Stories That’ll Make You Believe

- Your Burning Questions Answered

Key Takeaways

- Loan deferment allows temporary relief from payments under specific conditions.

- Eligibility varies based on income, hardship status, and loan type.

- Missteps in applications can lead to delays—or denials.

- We include actionable steps, tips, and even real-world case studies!

What Is Loan Deferment?

Picture this: You’re juggling bills, work stress, and life throwing curveballs daily. Suddenly, one bill starts looking insurmountable. Enter loan deferment. This lifeline pauses your loan payments temporarily without penalties. Sounds dreamy, right? But hold up—it’s not as simple as waving a wand.

Optimist You: “I’ll just ask nicely, and they’ll say yes!”

Grumpy Me: Oh, honey. Prepare yourself for paperwork that could fill an entire binder.

Cracking the Code: Who Qualifies?

So, who gets a golden ticket? The rules around deferment eligibility depend heavily on factors like loan type, current hardship, and repayment history. Let’s break it down:

Do I Qualify For Loan Deferment?

- Income Challenges: Lost your job? Suffering reduced hours? Lenders often approve deferments for folks experiencing severe income dips.

“If only crying counted as proof of financial hardship…”

- Economic Hardship Programs: Federally insured loans typically have built-in protections. Double-check if yours qualifies!

- Emergency Situations: Medical emergencies or natural disasters may open doors to temporary relief.

Terrible Tip Alert:

Sending an email begging for deferment with “PLEASE HELP OMG” won’t cut it. Lenders aren’t moved by panic—they need PROOF.

How to Apply Like a Pro

Okay, so you think you qualify. What now? Roll up those sleeves and dive into these steps:

- Gather Evidence: Pay stubs, medical records, unemployment forms—you name it. Think “proof salad.”

- Contact Servicer: Call or visit your lender’s website. Protip: Have your account info handy; no one likes waiting on hold longer than necessary.

- Complete Forms Correctly: Read EVERY question carefully. A missed checkbox could mean rejection city.

- Follow Up Persistently: Be polite but relentless. Treat follow-ups like water plants—consistent care = better results.

Top Tips + Terrible Advice To Avoid

This is where things get juicy. Trust me when I tell you—I learned these lessons the hard way.

Tips:

- Prepare Early: Don’t wait until you’re drowning to seek help.

- Use Official Channels: Always go through your lender’s official process. Scammers lurk everywhere!

- Keep Communication Records: Save emails, texts, and notes from calls. Documentation is king.

Rant Time: Why oh WHY do lenders make their websites nearly impossible to navigate?! If I see another spinning wheel loader…ugh.

Success Stories That’ll Make You Believe

Here’s a story straight from my own backyard:

A friend named Sarah hit rock bottom after unexpected medical bills. She spent weeks gathering docs but eventually secured a six-month deferment thanks to laser-focused effort. Today? She’s back on track financially—and credits clear communication with her lender for saving her bacon.

Your Burning Questions Answered

Q: What happens to interest during deferment?

Some loans accrue interest; others don’t. Check terms first.

Q: Can private loans be deferred too?

Possibly! Policies vary wildly between lenders.

The Bottom Line

Understanding deferment eligibility empowers you to tackle tough times head-on without crumbling under debt pressure. Keep calm, stay organized, and remember: Help exists—you just need to find it.

Meme moment: Remember Pokémon Snap? Finding deferment approval feels eerily similar. Stay sharp out there.